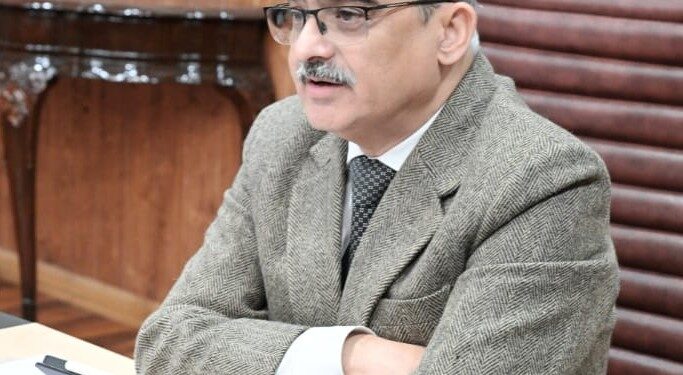

JAMMU: Chief Secretary, Atal Dulloo today inaugurated the Financial Literacy Week (FLW) 2026 for the Union Territories of Jammu & Kashmir and Ladakh.

The week-long programme is being organised by the Reserve Bank of India (RBI) from February 09 to February 13, 2026, with a focus on strengthening financial awareness and safe banking practices among citizens.

The event was also attended by Rachna Sharma, Secretary, Rural Development and Panchayati Raj Department; Sh. Vidhu Shekhar, Additional Deputy Commissioner, Jammu; Sh. Deepak Dubey, Joint Director Information, Jammu; Shri Vikas Mittal, GM/O-i-C, NABARD, Jammu; Shri Sunit Kumar, CGM, J&K Bank; controlling heads of banks; and officers and representatives from Government departments, RBI, banks, financial institutions and UTLBC J&K and Ladakh.

Addressing bankers and stakeholders on the occasion, the Chief Secretary observed that financial inclusion reflects the Gandhian principle of “Sarvodaya through Antyodaya”, both as a policy objective and as a shared responsibility of all institutions. He underlined that the importance of financial inclusion is evident from the fact that nearly seven of the seventeen Sustainable Development Goals (SDGs) are directly linked to financial access and empowerment of the masses.

Highlighting recent achievements, the Chief Secretary stated that during the three-month financial inclusion campaign conducted from July to October 2025, the Government, in collaboration with banking institutions, worked extensively at the Panchayat level to saturate benefits under various Government of India schemes including Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Jan Dhan Yojana (PMJDY), Atal Pension Yojana (APY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY). These efforts resulted in KYC updation of nearly 5.9 lakh accounts, covering about 51 percent of the targeted accounts.

He further noted that institutions such as RBI, NABARD, SEBI, PFRDA and banks are collectively working towards creating financial awareness among citizens. He added that financial integration through governance is also gaining momentum with the introduction of financial literacy lessons in JKBOSE curriculum, alongside livelihood training and skill development programmes.

Speaking about this year’s theme, “KYC – Your First Step to Safe Banking”, the Chief Secretary emphasised the need for adopting a Centralised KYC mechanism, which, like UPI, can simplify financial transactions and credit access while ensuring account hygiene and strengthening defence against financial fraud and cyber threats. He reiterated that the vision of Viksit Bharat and sustainable development is closely linked to comprehensive financial inclusion.

Stressing the importance of grassroots outreach, he called for greater use of Common Service Centres (CSCs) as effective last-mile delivery platforms. He also emphasised leveraging the network of Self Help Groups (SHGs), which have nearly 8 lakh members across J&K, to enhance financial awareness at the community level. Additionally, he suggested using ATM kiosks, social media platforms and railways as tools for mass financial awareness, stating that financial literacy directly translates into financial empowerment.

This year’s theme, “KYC – सुरक्षित बैंकिंग की ओर पहला कदम / KYC – Your First Step to Safe Banking”, focuses on sub-themes including Basics of Know Your Customer (KYC), Central KYC Registry (CKYC), and Account Hygiene and Financial Discipline. The theme aims to highlight the importance of KYC as the foundation of safe and secure banking.

In his opening remarks, Chandrashekhar Azad, Regional Director, RBI Jammu, highlighted that last year a nationwide campaign was undertaken at the Gram Panchayat level to saturate Financial Inclusion schemes, including re-KYC of bank accounts. RBI Jammu, along with banks and stakeholders in J&K and Ladakh, actively supported the campaign to ensure re-KYC enrolment for eligible account holders.

Building on the awareness created through the campaign, FLW 2026 focuses on educating the public on all aspects of KYC compliance. The campaign emphasises that while KYC is a regulatory requirement, it is simple to complete through multiple safe and convenient modes. It also aims to familiarise citizens with facilities like Central KYC (CKYC), which simplifies the KYC process.

Further, the campaign encourages citizens to remain alert against fraudulent calls, messages and links related to KYC updation, which can result in financial loss. It also sensitises the public about the serious consequences of becoming money mules due to inducements.

During the week, RBI, in collaboration with banks and stakeholders, will conduct awareness programmes and outreach activities across the country, including the Uts of Jammu & Kashmir and Ladakh. These initiatives will continue throughout the year to ensure sustained impact.

Through these collective efforts, RBI aims to reinforce the message that KYC is not merely a regulatory requirement, but a vital step towards building a secure, transparent and trustworthy financial ecosystem for all.