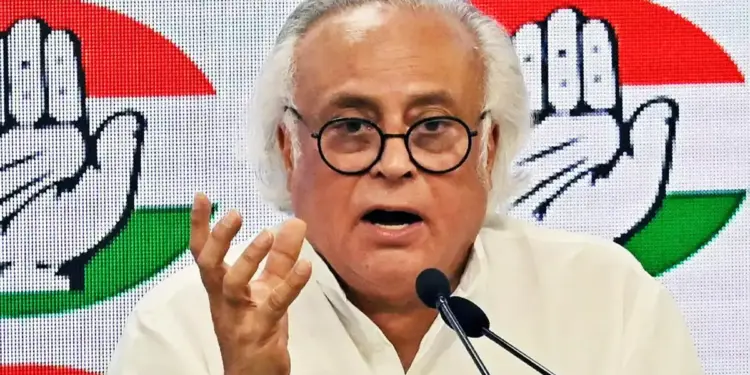

New Delhi: Opposition-ruled states have extended their support to cut the number of GST rate slabs and the rates for mass consumption items, while demanding a mechanism to ensure the benefits get passed on to consumers, Congress leader Jairam Ramesh said on Saturday.

He also said the Congress hopes that next week’s GST Council meeting would not be just a “headline-grabbing exercise so typical of the (Narendra) Modi government”.

According to Ramesh, the eight opposition-ruled states have also demanded compensation to all states for a period of five years, with 2024-25 as the base year, since their revenues are bound to be adversely impacted by the rate cuts.

They have demanded additional levies on ‘sin’ and luxury goods over and above the proposed 40 per cent be fully transferred to states, he said.

“Eight opposition-ruled states — Karnataka, Himachal Pradesh, Jharkhand, Kerala, Punjab, Tamil Nadu, Telangana, and West Bengal — have extended their support to the reduction in the number of GST rate slabs and a reduction in the rates themselves for items of mass consumption,” the Congress general secretary in-charge of communications said on X.

He said these states have also called for a mechanism that ensures that the benefits of the rate cuts get passed on to consumers.

They have also demanded compensation to all states for a period of five years with 2024-25 as the base year, since their revenues are bound to be adversely impacted by the rate cuts, Ramesh said.

The eight opposition-ruled states have also called for additional levies on ‘sin’ and luxury goods over and above the proposed 40 per cent to be fully transferred to states, he said, adding the Centre gets close to 17-18 per cent of its revenue from various cesses that are not shared with the states.

The Congress leader stressed that these demands are perfectly legitimate and are bolstered by recent papers published by the Union Finance Ministry’s own National Institute of Public Finance and Policy (NIPFP).

According to him, the Congress has for long been demanding a GST 2.0 that not only reduces rate slabs and cuts rates but also drastically simplifies procedures and compliance requirements, especially for MSMEs.

Ramesh further said the Congress has also been stressing the essentiality of ensuring that the interests of all states are fully protected.

“It hopes that the GST Council meeting scheduled for next week will not be merely a headline-grabbing exercise so typical of the (Narendra) Modi government, but will also advance the cause of genuine cooperative federalism in letter and spirit,” he added.

The high-powered GST Council, chaired by Finance Minister Nirmala Sitharaman, will meet on September 3-4 to discuss moving to a two-slab taxation. The two-day meeting will be held in New Delhi.

The council, comprising finance ministers of all states and Union Territories, besides that of the Centre, will deliberate on the recommendations made by the three GoMs on rate rationalisation, compensation cess and health and life insurance.

Earlier this month, the Congress demanded an official discussion paper on GST 2.0 for a wider debate on it, and said the reform should be towards a “Good and Simple Tax” in letter, spirit, and compliance, and not the “Growth Suppressing Tax” it has become.

The opposition party’s assertion had come after Prime Minister Narendra Modi announced that GST rates would be lowered by Diwali, bringing down prices of everyday use items, as his government looks to reform the eight-year-old regime that has been plagued by litigation and evasion.