India’s market capitalization to become $10trn by 2030

PIB Feature

Global investment advisory firm Jefferies has projected an optimistic outlook for Indian economy and its equity markets. In its latest note, the New York headquartered firm has said that in the last ten years, India has seen fundamental structural reforms which have created the framework for the country to realise its full potential. It said “over the next 4 years, India’s GDP will likely touch $5 trillion making it the 3rd largest economy by 2027, overtaking Japan and Germany, maintaining the status of fastest growing large economy”

In the process of sustained economic growth, Jefferies expects Indian stock market to hit US $ 10 trillion by 2030. The report observes “India’s market capitalization at $ 4.3 trillion ranks 5th in the world behind USA ($ 44.7 trn), China ($ 9.8 trn), Japan ($ 6 trn) and Hong Kong ($ 4.8 trn). Indian equity markets have been able to generate consistent 10% annual returns in dollar terms over the last 5-20 years periods; much better than any of its global peers in the emerging market space”. The firm notes that with a renewed Capital Expenditure cycle and robust earnings profile, Indian markets will continue to deliver attractive growth over the next 5-7 years.

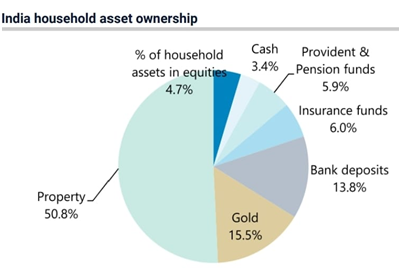

Jefferies further observes that Indian markets are still under penetrated with just 4.7% of household savings in equities. However, digital advancement in India has blurred the lines between traditional and retail investors. With technology at their fingertips, retail investors now enjoy unprecedented access to the stock market, thus democratizing the investor profile. Furthermore, the Systematic Investment Plans (SIPs) have gained immense popularity reflecting a disciplined approach to investment among retail investors. The report says “With growing awareness around investment through mutual funds by regulators and the Finance Ministry, we expect to see much more savings flowing into India’s equity markets.”

Opportune time for multinational companies to list in India

Jefferies further says that a strong growth profile, rising weight of Indian markets and track record of generating high returns should attract incremental foreign investment flows. Citing the example of South Korean multinational Hyundai India’s decision to list its Indian subsidiary, the report says time is opportune for several multinational companies with a strong foothold in the country to become listed entities.” If larger global companies like Amazon, Samsung, Apple, Toyota etc. were to think on these lines – it can be a game changer for Indian equity capital markets” it adds.

Sustained reforms have laid foundation for strong future

The report credits sustained reforms undertaken by the Government for creating an ecosystem for high growth. “Since 2014, the Modi government has successfully delivered on a set of reforms with the aim of boosting ‘Ease of Doing Business’ in the country. The landmark GST reform of 2017 compressed a multitude of taxation structures into a common national system, akin to creating a ‘Eurozone’ style flow of goods and services across the Indian states. The Bankruptcy Law of 2016 proved crucial in accelerating the cleanup of the bad loans from the banking system. The Real Estate Regulatory Act (RERA) of 2017 helped to clean up the vast, unorganized property sector” the report adds.

In conclusion the Jefferies report says “In a world of rising geo-political tensions, India has deftly managed to remain on good terms with the G7 while also being fully signed up member of BRICS, as reflected in the widely acknowledged success of the G20 Summit held in Delhi last September”.

Courtesy PIB, Srinagar