New Delhi: The government on Tuesday raised the deposit threshold limit to Rs 5 lakh per annum in provident fund for which interest would continue to be tax exempt.

This would be applicable to those cases where no contribution is made employers to the retirement fund.

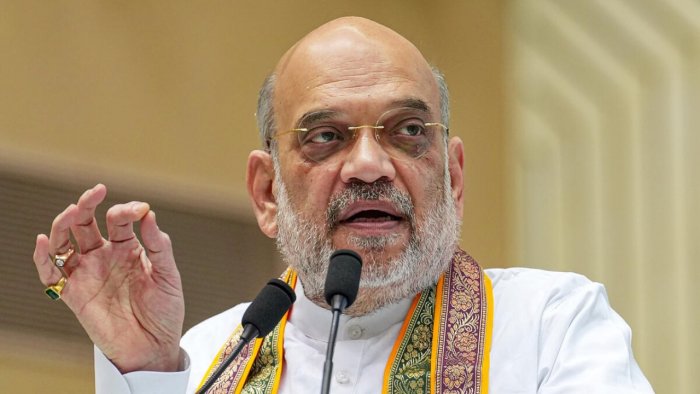

In her Budget presented to Parliament on February 1, Finance Minister Nirmala Sitharaman had provided that interest on employee contributions to provident fund over Rs 2.5 lakh per annum would be taxed from April 1, 2021.

Replying to the debate on the Finance Bill 2021 in the Lok Sabha, Sitharaman made the announcement regarding raising the limit to Rs 5 lakh in cases where employers do not make contributions to the provident fund.

The Finance Bill, which gives effect to tax proposals for 2021-22, was approved by voice vote.

The bill was passed after acceptance of 127 amendments to the proposed legislation.

The minister also stressed that tax on interest on provident fund contribution affects only 1 per cent of the contributors, and the remaining are not impacted as their contribution is less than Rs 2.5 lakh per annum.

Referring to the issues raised by various members on higher taxes on motor fuel, Sitharaman said she would love to discuss the issue of bringing petrol and diesel under GST in the next GST Council meeting.

She also sought to remind members that it was not just the Centre which taxes motor fuel and states too impose levies.

The finance minister also said rationalisation of customs duty structure will be undertaken to help domestic businesses, especially the MSME segment.

On taxes, she emphasised on the need for widening the tax base. With regards to the equalisation levy, she said this is meant to provide a level playing field to domestic businesses which pay taxes in India.