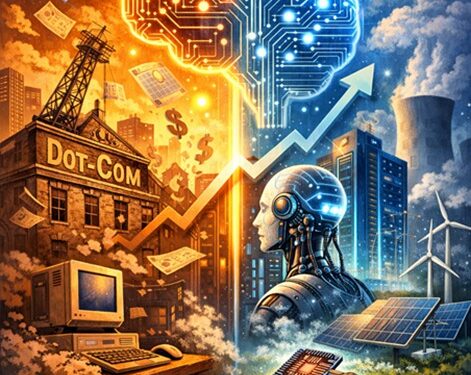

Every major technological shift arrives with excitement, excess, and anxiety. In the late 1990s, the Internet triggered the dot-com bubble, an era of speculation that ended in collapse but ultimately reshaped the global economy. Today, Artificial Intelligence stands at a similar crossroads, prompting the question: Is AI another bubble waiting to burst, or a lasting transformation?

There are similarities, but the differences are crucial. The dot-com era was driven largely by speculative investment in companies with weak or non-existent business models, many of them dependent on borrowed money. When the bubble burst, thousands failed. Yet survivors such as Amazon and eBay emerged stronger, proving that technological revolutions can outlive financial manias.

The AI boom of the 2020s is being led not by loss-making startups alone, but by highly profitable technology giants reinvesting their own cash flows. Massive investments are going into real infrastructure: advanced chips, cloud platforms, and data centres, to meet growing demand. AI is also already embedded in everyday life, from navigation apps and recommendation systems to healthcare diagnostics, fraud detection, and generative tools that boost workplace productivity.

One factor that sets AI apart from earlier technology cycles is energy. Unlike the dot-com era’s fibre-optic networks, AI runs on electricity. Training and operating large AI models requires enormous computing power, and data centres can consume as much energy as small cities. This has raised concerns about whether power shortages, environmental costs, and grid limitations could slow AI’s expansion.

So far, leading companies see energy as a challenge to solve rather than a barrier. They are investing in renewable power, long-term energy contracts, more efficient data centres, and next-generation chips that deliver greater performance per watt. While energy constraints may slow deployment in some regions or concentrate AI infrastructure in countries with stronger grids, they are unlikely to halt progress. Instead, they may accelerate investment in cleaner energy and modernised power systems.

As with the dot-com era, risks remain. Valuations are high, expectations are lofty, and some degree of correction seems inevitable. Not every company will survive. But history suggests that the failure of some players does not invalidate the technology itself.

AI may exhibit bubble-like features, but it is not an illusion. Like the internet before it, the hype may fade, and capital may be lost, yet the underlying transformation is likely to endure, reshaping economies, industries, and daily life long after today’s excitement subsides.

The author is a painter, writer, and senior marketing professional with more than 25 years of experience working with leading semiconductor companies and can be reached at aijazqaisar@yahoo.com.