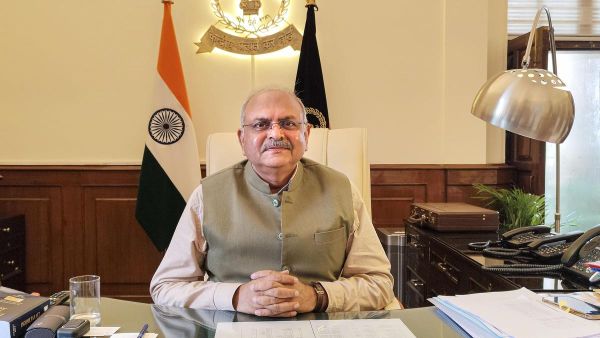

New Delhi: CBDT Chairman Ravi Agrawal has asked the Income Tax Department to be ready and active for the new direct tax law that will be implemented this year from April 1, saying he expects tax officials to work with clarity and purpose.

In his customary new year communication to the staffers of the department, the Central Board of Direct Taxes (CBDT) chief said new rules, procedures and forms were under formulation for this transition.

The CBDT is the administrative body for the I-T Department.

The new I-T Act will replace the over six-decade-old current Income Tax Act of 1961.

Calling 2026 a year of “special significance” for the department, the head of the direct taxes administration in the country urged the officials for their “readiness, understanding of the law and shared confidence in its implementation”.

“This year carries special significance. With the Income Tax Act 2025 notified and scheduled to take effect on 1 April, 2026, we prepare for the shift to the Income Tax Act 2025.

“New rules, procedures and forms are under formulation and training and capacity building are already underway,” Agrawal wrote to the department officials in his January 1 letter.

PTI has accessed the communication in which the CBDT chief has stated that the months ahead will require their “active involvement in training and familiarisation so that we understand the intent and structure of the new law and are able to guide tax payers with clarity”.

“Your involvement and curiosity will shape how smoothly we make transition,” he said.

Agrawal added that the approach to tax administration was “evolving”.

“Beyond collection (of revenue and taxes) and enforcement, the role of the department is increasingly centred on facilitation, trust and service. Technology will be central as systems evolve to align with the new framework,” he said.

He further said that familiarity with data platforms and automated processes will become integral, particularly for the younger officers and staff, who will lead the tax department in the coming years.

Reflecting upon the year 2025, the CBDT chairman said the organisation worked with “close oversight” on issues related to grievances, rectification of orders and pending appeals.

“Expectations were high and timelines demanding, yet colleagues across the country showed resilience and delivered,” Agrawal said, as he lauded the “sincerity” of the tax officials even when their effort was “unseen”.

He said “changing” business and transaction patterns brought new “financial complexities” while also opening space for the department to build sharper insight and capability, for which continuous learning by the tax officials was essential.

The CBDT chief asked the tax officials to strengthen “behavioural” administration through the NUDGE (Non-intrusive Usage of Data to Guide and Enable) framework which encourages the taxmen to use data for better communication to foster voluntary compliance by taxpayers.

“These values live through our decisions, big or small…every member strengthens the integrity of the tax system and the work we do each day quietly supports the nation’s financial architecture,” he wrote.

“As 2026 unfolds, may we work together with diligence, clarity and purpose,” he stated.