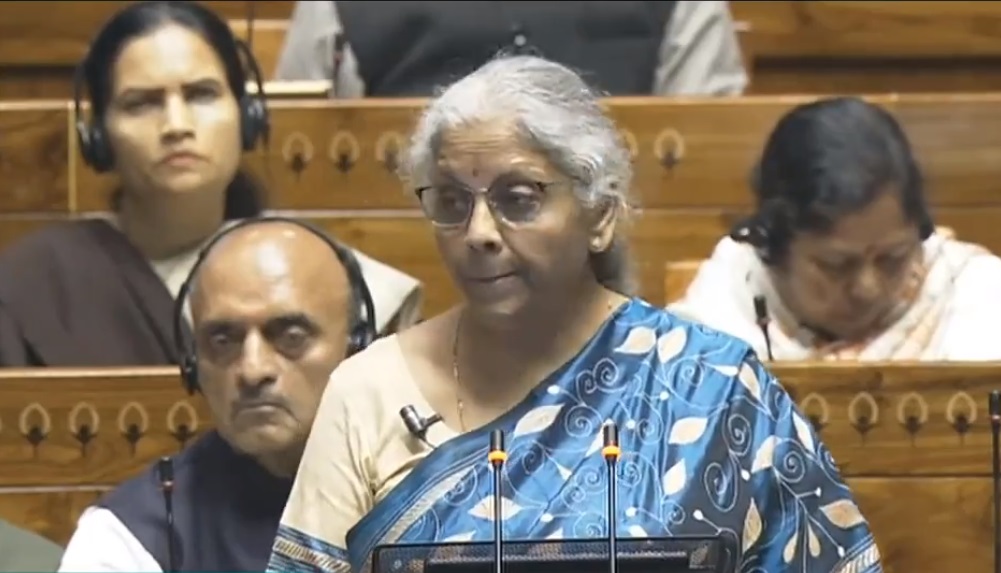

New Delhi: Finance Minister Nirmala Sitharaman on Friday introduced in the Lok Sabha the Banking Laws (Amendment) Bill, 2024, which seeks to give customers an option to increase the number of nominees per bank account to four, from existing one, among others.

Another proposed change relates to redefining ‘substantial interest’ for directorships, which could increase to Rs 2 crore instead of the current limit of Rs 5 lakh, which was fixed almost six decades ago.

Congress member Manish Tewari opposed the introduction of the Bill saying the power to legislate with regard to cooperative societies vests with state governments.

Sitharaman said the banking regulation act and the cooperative banks do have a relationship and hence any amendment has to be taken through this route.

“There is no attempt to undermine the cooperatives, particularly cooperatives dealing with everything other than banks. Banks, cooperatives with a licence for banking will have to have a rule and therefore we have shown this,” Sitharaman said while introducing the Bill.

The Bill also seeks to give greater freedom to banks in deciding the remuneration to be paid to statutory auditors.

It also seeks to redefine the reporting dates for banks for regulatory compliance to the 15th and last day of every month instead of the second and fourth Fridays.

The Bill, which was approved by the Union Cabinet last week, proposes to amend the Reserve Bank of India Act, 1934, the Banking Regulation Act, 1949, the State Bank of India Act, 1955, the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 and the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980.

The announcement about amendments to the Banking Regulation Act was made by the Finance Minister in her 2023-24 Budget speech.

“To improve bank governance and enhance investors’ protection, certain amendments to the Banking Regulation Act, the Banking Companies Act and the Reserve Bank of India Act are proposed,” she had said.