JAMMU: Jammu and Kashmir State Taxes Department (STD) in collaboration with the Institute of Chartered Accountants of India (ICAI) today organised a day-long Capacity Building Programme (CBP) on various provisions of Goods and Service Tax for State Tax Officers (STOs) at Excise and Taxation Complex here.

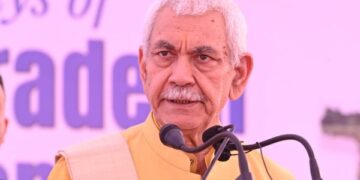

The programme was inaugurated by Commissioner, STD, Prediman Krishen Bhat in the presence of the Additional Commissioner (Administration & Enforcement), Jammu, Namrita Dogra and Additional Commissioner, (Administration & Enforcement), Kashmir, Shakeel Maqbool.

Speaking on the occasion, the Commissioner said that audit is a very important component of the taxation system and all the officers should be well versed with accounting principles and other accounting procedures. He remarked that our audit observations should be based on facts so that they can’t be challenged.

Sharing his experience, the commissioner said that tax officers, who conducted audits, should be trained in the process and hoped that the workshop would clear all their doubts and make their understanding about this subject very clear.

The Commissioner highlighted that the session has been arranged to enhance the subject knowledge of officers which will prove fruitful and sharpen their skills to learn new things.

In his address, Namrita Dogra expressed gratitude to ICAI representatives and said that this programme not only enhances the productivity of tax officers of the department but also promotes significant partnerships between the Chartered Accountant community for larger economic growth of the nation.

During the programme, resource persons from ICAI delivered interactive and informative lectures for STOs on various provisions of GST and its related aspects.

In the first session, ICAI’s resource person, CA Archana Jain delivered an interactive lecture on Audits, types of tax invoices, and debit and credit notes and thoroughly covered all aspects of Audit with live examples. She stressed on cross-checking all the invoices for proper scrutiny and strict to the laws written in rule books.

In the second session, CA Tarun Arora covered Input Tax Credit (ITC) and explained all the components attached to ITC. He deliberated in detail on the scrutiny and analysis of ITC under GST.