‘Financing the Future of Agriculture’

Jammu: Lieutenant Governor Manoj Sinha Sunday exhorted the banking sector to play a lead role in realizing the dream of accelerated development of Agriculture & allied sectors.

He also assured all the assistance to farmers and adequate funds for the revival of cooperative banks.

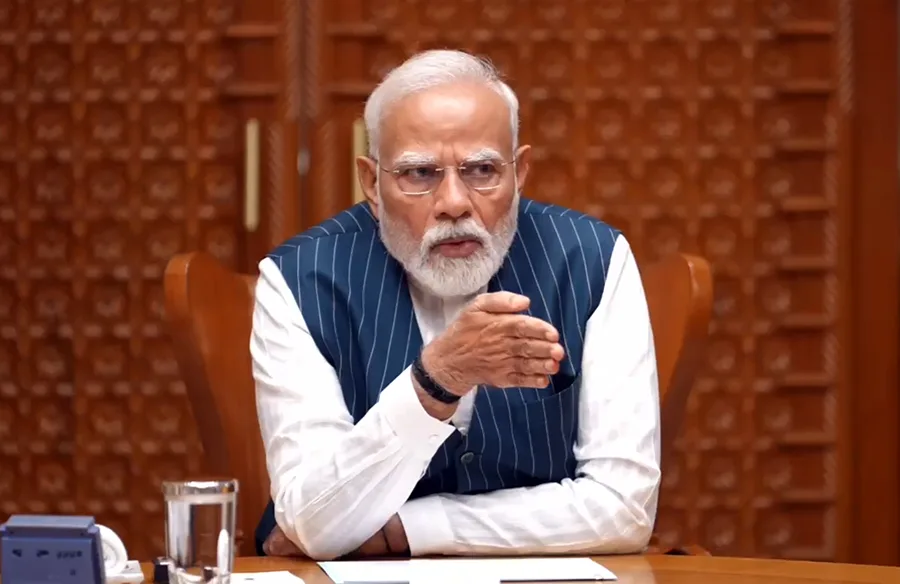

Addressing a seminar on ‘Financing the Future of Agriculture’ in Jammu, which brought together the stakeholders in agriculture sectors and banking institutions, the LG said, “In the first budget of Amrit Kaal, Prime Minister & Finance Minister has shown the way for inclusive development & empowering every section of society with the vision of ‘Vanchito ko Variyata’ and giving priority to the Agriculture sector.”

Agriculture Accelerator Fund envisaged in this year’s budget, he said will encourage agri-startups in rural areas. “It will provide entrepreneurial opportunities to local youth and affordable solutions to tackle challenges in the agriculture sector. The agriculture credit target has been increased to Rs. 20 lakh crore with a focus on animal husbandry, dairy, and fisheries,” he added.

According to an official press release, highlighting the transformation in the agriculture sector, the LG said the progressive reforms introduced by the administration in the last three years are paying the dividends to the farmers.

“The Amrit Kaal provides us an opportunity to transform the agriculture sector and also protect the farmers from effects of unpredictable markets, climate change, and loss of biodiversity,” he observed.

Projects under holistic development of agriculture & allied sectors being implemented in J&K UT is one amongst the few major long-term and groundbreaking interventions in the agricultural horizon of the country, the LG said.

“The revolutionary projects worth Rs 5013 crore for holistic development of agriculture and the allied sector will provide practical solutions to meet the future challenges, accelerate the growth momentum and usher in a new era of farmer prosperity and rural livelihood security in J&K UT,” he added.

The LG impressed on all stakeholders for the successful implementation of the projects under holistic development of agriculture & allied sectors.

The LG said the holistic development of agriculture and allied sectors will develop a strong ecosystem of agriculture entrepreneurs in Jammu Kashmir and create jobs in the sectors. It will cross the Rs 30,000 crore mark in the 4th year, he noted.

The LG further emphasized on streamlining the institutional credit flow to the farmers.

“J&K has its share of challenges of geo-climatic conditions which are mostly affecting small & marginal farmers. The onus lies on all banks to connect these farmers with the banking system,” observed the LG.

Banking institutions are the most important support system to ensure maximum institutional credit reaches the farmers, especially in unbanked villages, he noted.

“Promoting institutional credit in the agriculture sector will be a game changer in strengthening the agriculture economy and realizing the goal of inclusive and balanced development. Credit access for tenants, small and medium farmers must be ensured,” he said.

The LG further underscored the significant role of the regional rural banks in credit flow and the extension of credit facilities to every farmer.

“In the last eight years, credit by the commercial banks has doubled. Still, we have to increase the credit flow and ensure equal disbursement of institutional credit and identify the areas which are facing inequality,” observed the LG.

The LG asked the banks to work in a planned manner and ensure time-bound saturation of KCC for all farmers associated with agriculture & allied activities. He further asked the J&K Bank to organize a programme to honour the women associated with agriculture & allied sectors.

“The banking industry needs to serve the small & marginal farmers, youth, and women agripreneurs and act as a catalyst for growth. It must be ensured that every woman who wants to become an agripreneur should receive hassle-free financial assistance,” said the LG.

Rajeev Rai Bhatnagar, Advisor to the LG; Atal Dulloo, Additional Chief Secretary, Agriculture Production Department; Dr Ashok Dalwai, CEO, National Rainfed Area Authority; Yasha Mudgal, Commissioner/Secretary Cooperatives Department; Kamal P Patnaik, Regional Director RBI; Baldev Prakash, MD & CEO J&K Bank; Dr Ajay Kumar Sood, CGM NABARD Jammu, and members of Kissan Advisory Board present on the occasion also shared their views on the role of financial institutions in Agriculture sector.