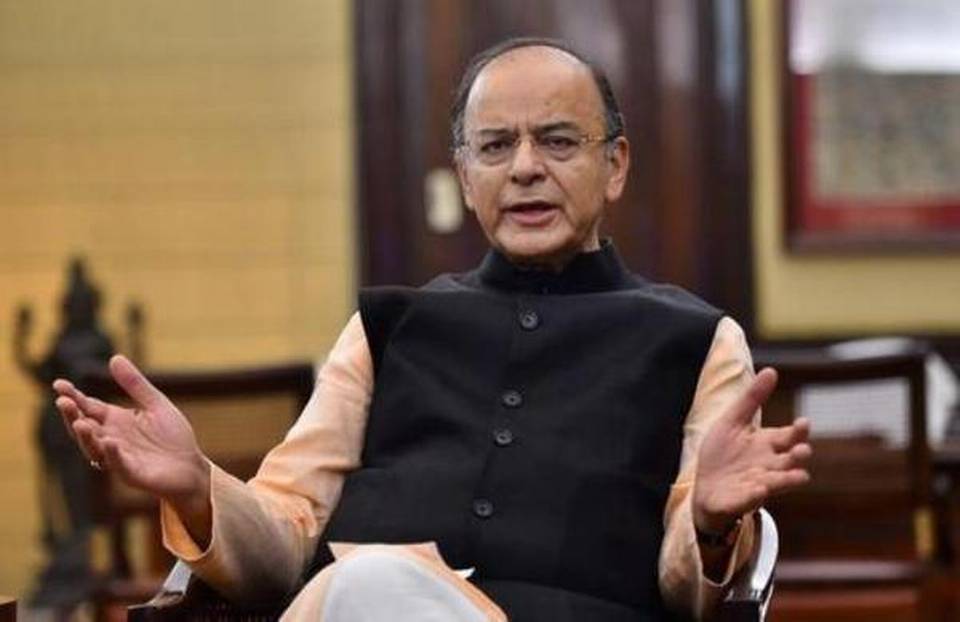

NEW DELHI: Buoyed by GST collections exceeding Rs. 1 lakh crore in April, Finance Minister Arun Jaitley on Tuesday said it is a landmark achievement and a confirmation of increased economic activity.

The government mopped up Rs. 1.03 lakh crore in GST collection in April, indicating stabilisation of the new indirect tax regime which was rolled out on July 1 last year.

While Goods and Services Tax (GST) collection in entire 2017-18 stood 7.41 lakh crore, in March the figure was 89,264 crore.

“GST collections in April exceeding 1 lakh crore is a landmark achievement and a confirmation of increased economic activity as brought out by other reports,” Jaitley said in a tweet.

In another tweet, he said that with the improved economic climate, introduction of e-way bill and improved GST compliance, the indirect collections would continue to show a positive trend.

Earlier in the day, the Finance Ministry said, “The total gross GST revenue collected in April 2018 is 1,03,458 crore of which CGST is 18,652 crore, SGST is 25,704 crore, IGST is 50,548 crore (including 21,246 crore collected on imports) and Cess is 8,554 crore — including 702 crore collected on imports.

The buoyancy in the tax revenue of GST reflects the upswing in the economy and better compliance, the Ministry said in a press release.

However, it is usually noticed that in the last month of financial year, people also try to pay arrears of some of the previous months also and, therefore, April 2018 revenue cannot be taken as trend for the future, it added.

The total revenue earned by the central and state governments, after settlement in April, is 32,493 crore for Central GST and 40,257 crore for State GST, it said.

As far as total number of GSTR 3B returns for March up to April 30 is concerned, nearly 69.5% have filed returns.

As many as 60.47 lakh as against 87.12 lakh, who are eligible to file returns for March, did the needful, it said.

April was also the month for filing of quarterly returns for composition dealers, it said.

Out of 19.31 lakh composition dealers, 11.47 lakh have filed their quarterly return (GSTR 4) and have paid total tax of 579 crore, which is included in 1.03 lakh crore of total GST collection, it added.